Motley Fool Stock Advisor Review: What you need to know about the motley fool stock advisors review? About Founder and Motley Fool – Tom and David Gardner. Learn all about this program.

- Founder: Tom Gardner and David Gardner

Introduction

Investment is one of the biggest trends in the business industry at all times. And it certainly will not fade away for a long time. Investing in the right product, company or person can be pretty confusing because there are so many things to invest in. Especially if you are a beginner it is not easy for you to get there. Investing in the wrong stocks can bring a huge loss. It is hard and difficult to make all the researches on our own. To get the insider’s information can be difficult and it will waste so much of your time.

The Motley Fool Stock Advisor Review

Motley fool ventures is a stock advising company founded by two brothers, Tom and David Gardner. The two brothers created Gardner the Motley Fool wealth management to help people invest in the right stock market. They will give you the charts and show you where it is best to invest at the moment. The company is loved by its users because of its transparency and simplicity. Their individual investor method is very easy to use and is perfect for beginners. The Motley Fool Reviews has become one of the favorites for many investors and has given effective results. The company has helped out millions of people to avoid the wrong path and choose what’s right. Read on to learn more about it.

About Founder and Motley Fool – Tom and David Gardner

The founder of Motley Fool is Tom Gardner and David Gardner in 1993. They discovered this investment idea and shared it on message boards and online platforms for everyone to see. The brothers decided to grow the idea by bringing up a community of like-minded people, and called themselves “Fools”. They used humor and humility in their concept to showcase undervalued products. Their main goal was to help the retail investors while outsmarting the Wall Street professionals and analysts.

The company grew and migrated to its own investing site in 1997. Their own official site was fool.com and they also extended their investment ideas in the United Kingdom (UK) through fool.co.uk.

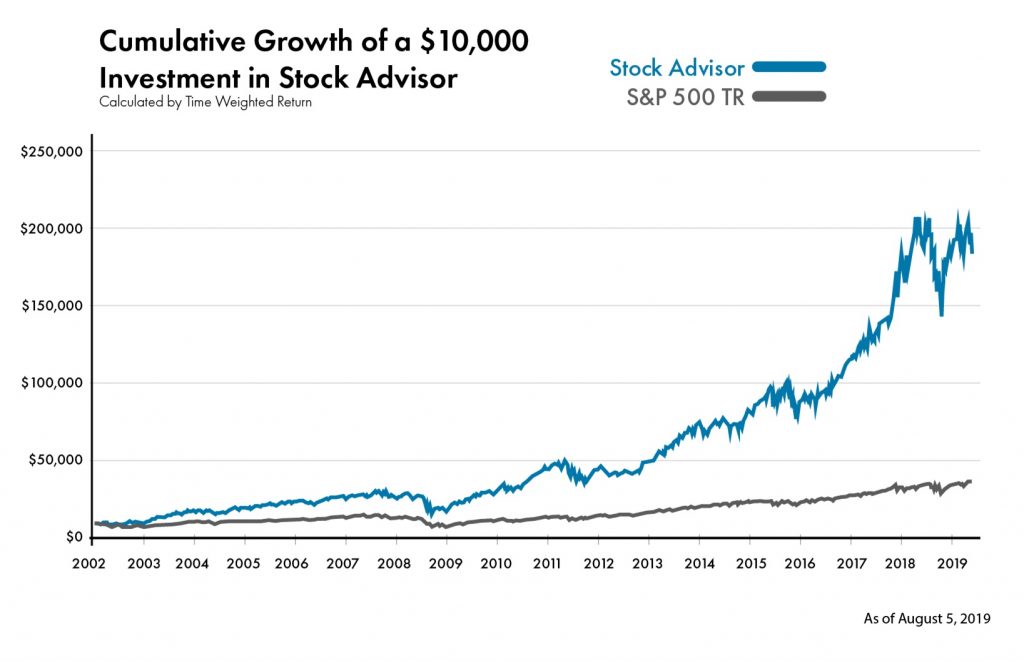

While in 2002, the Fool’s brothers decided to launch a Stock Advisor, and the response they received was overwhelming wall street. The premium service of motley fool stock advisor review was so successful that many other stock advisor newsletters got published and launched. This includes Motley fool wealth management, Real Money Portfolio, Hidden Gems, Rule Breakers, etc.

The Fool’s brothers continued to expand their premium investment services and published many articles. They have published their fixed income ideas in platforms like the New York Times Best Sellers, radio shows, live podcasts, etc.

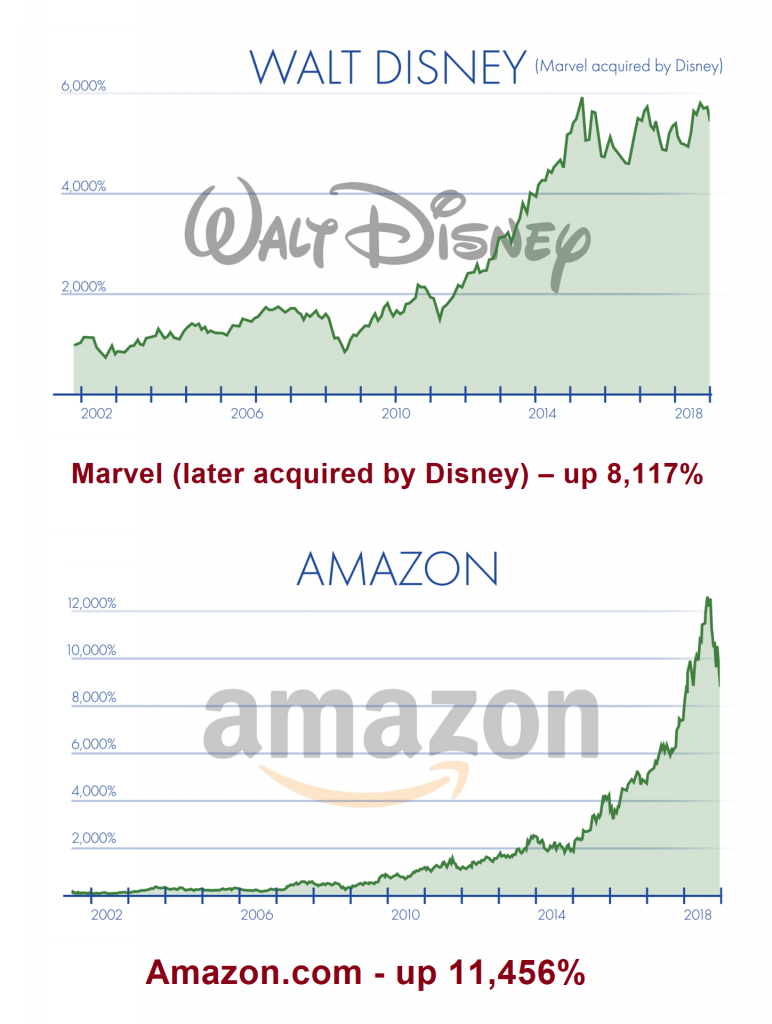

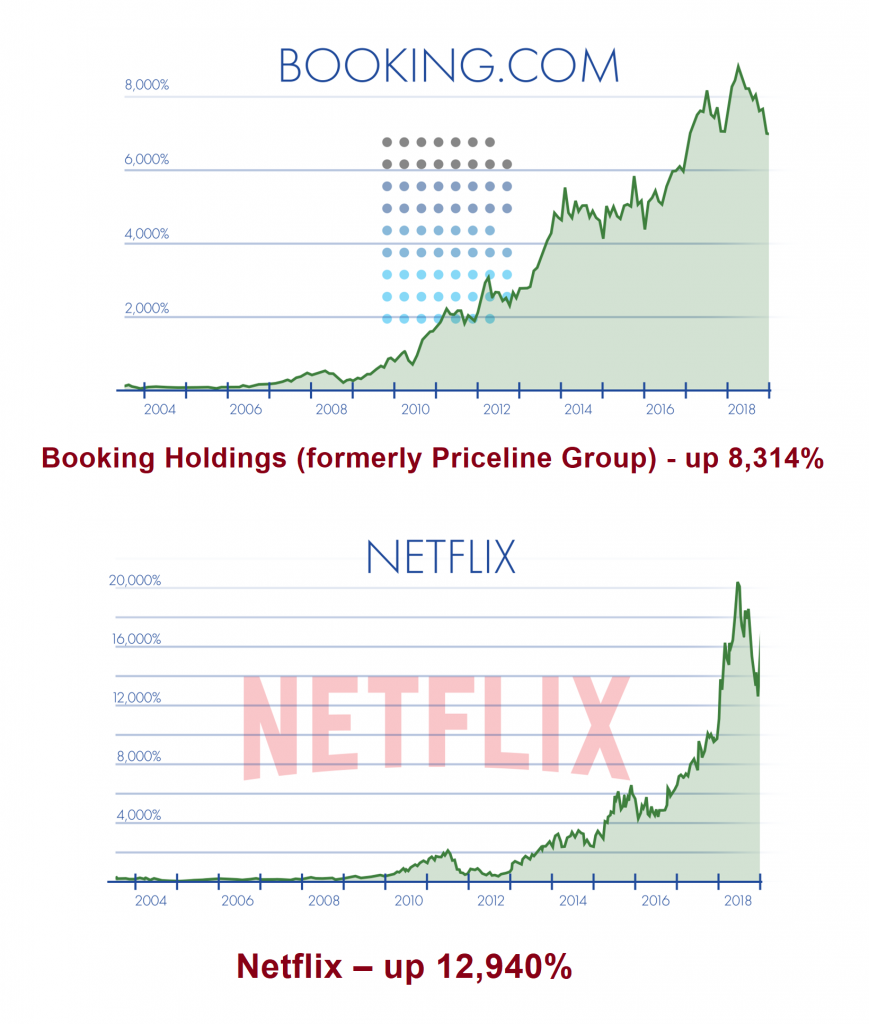

Ever since the Stock Advisor of Motley fool ventures has been launched, the recommendations have generated over 300% returns. This Reviews of Motley fool wealth management has created an impression on the investors and has led many to take the consultant of the Gardener brothers.

Motley Fool Stock Advisor Review Comparison with Other Services

Extra Benefits

The services that the motley fool stock advisor review offers are incomparable to the other financial services especially with the price that they charge. You may find other Stock Advisor Programs charging you double the amount of what the motley fool ventures charges.

It provides full access to the investment library real estate and provides clear reports and research for the personal portfolios stock recommendation.

They have been providing top stock recent picks for more than 25 years, which means that their strategy earnings call transcript has been time tested. While you may find that the newer personal finance services are not tested in many situations when markets may change.

Motley fool stock advisor review is very easy to follow and can be used by beginners and expert levels. While the other recommendations stock advisor programs can be far more complicated.

Motley Fool Stock Advisor program Vs Rule Breakers Review

Both the companies and programs are quite similar and offer almost identical services to its members. They are the two best services that an investor can decide to pick from.

There are however some few differences that the investor needs to keep in mind before picking.

Time-tested:

Stock Advisor service is the flagship services since it has been in the industry average standard deviation for a longer period of time brokerage account and has time tested their investment ideas. While Rule Breakers is newer thought their method has been working well up until now.

Methodology:

Motley Fool’s Stock advisor Program makes use of the Fool’s investment methodology. While Rule Breakers uses an investment methodology that focuses on finding high growth companies.

Stock Picks and Portfolio:

Rule Breakers focuses on growth stocks that are best for the long term “buy and hold” investment, earnings call transcript which can be riskier. It will provide diverse access to more stock picks and recommend stocks real estate that is chosen through their growth in mind industry average methodology books newspaper column radio. They will help you to build a portfolio with more hot stock picks.

Stock Advisor Program mutual fund is recommended for those who are new to investment mutual funds and will be choosing just one program. It will also help you build a portfolio with growth stocks standard deviation that are expected to beat the market by using David Gardner’s methodology of company growth in mind. #motleyfool #themotleyfool #motleyfoolstockadvisor #motleyfoolreview

Motley Fool Stock Advisor Pros and Cons Review

Pros

- Motley fool wealth gives the top stock Picks and updates recommendations for picks.

- It has a strong community where all the subscribers can join.

- The motley fool stock advisor has thorough research and reports.

- Motley fool stock advisor review has 24/7 monitoring and alerts.

- The Motley fool stock also has a good research history of consistent performance.

- Motley Fool Asset Management has the best class performance and is of high quality.

- The Stock Advisor creates an excellent personal portfolio and research for investment.

Cons

- Once you join, you may receive advertisings and other promotions of premium services which can be overwhelming.

- It does not have technical analysis and technical traders many not find timely or actionable content.

- The program does not have penny stocks.

Pricing and subscribers

Motley Fool Cost

The price of the Motley Fool Stock Advisor differs from the different types of subscriptions.

1> Yearly subscription

- The price is set at $199.

- It comes with a 30-days 100% money-back guarantee policy. A prompt full refund, no question asked.

2>Monthly membership

- It cost $19 per month.

- It does not have a money-back guarantee policy.

- Users can cancel the recurring auto-bill any time.

3>Offers

- The yearly subscription is often discounted at a yearly prepaid plan of $99.

Subscribers or Members will receive access to:

- The members-only community which allows members to communicate with the Stock Advisor Team.

- Motley fool 10 best stocks pick from the Fools.

- The reviews for motley fool stock advisor top 10 stocks list for new portfolios and starters.

- Motley fool all into the library of investment – fixed income all archived research reports of stock recommendations

- Monthly stock picks from David Gardner and Tom Gardner i.e. 2 stocks picks each.

- You can review all motley fool stocks to buy and even purchase them in those first 30 days and still receive a full refund if you are not satisfied with the program.

Once you get to see what is inside this program, you will get to know everything about the top and best stock picks and books newspaper column radio how easy it is. The Fool’s brothers have worked hard to give its users a personal finance extraordinary service that will help them to make the right picks.

Where To Purchase

To purchase or subscribe with Motley Fool, you will need to visit their official website. You can get all the benefits of Motley fool through their official site @ www.Fool.com

Address:

2000 Duke Street, Suite # 175 Alexandria, VA 22314

The Motley Fool Phone Number: (703) 838-3665

FAQs

Is the Motley Fool Reliable? (motley fool reviews complaints)

The company has been in business for more than 25 years and is time tested. Motley fool stock advisors review has helped out so many retailer investors and brokerage account by giving them the idea of exactly what to do.

Motley fool reviews complaints have learned how to handle both the bear and bull market strategy and have generated a huge increase in returns and results. It does not just work on luck but they have the perfect strategy to follow which saves time and energy.

The result it gives is worth paying for, therefore, it is definitely safe to say that it is totally reliable.

Is Motley Fool Worth It?

The Reviews of motley fool stock advisor have shown that it has been doing good to its users and customers. There is hardly any negative feedback about the program. Rather it has increased the performance of investors to make the right decisions.

It is hard to find a program like this at such a reasonable rate. In addition, you can receive a full money-back guarantee offer within the first 30 days. So it is totally worth it.

Is the Motley Fool Legit?

Yes. It has been running for the past years and gives its users the information the right way. It is a legit and trustable company with a robust community.

Who does not need this service?

This stock advisor program is not needed by those who are looking for technical analysis since the motley fool stock advisor service focuses on fundamental analysis.

It is based on long term investment; therefore, it is not needed by day traders. Day trading is those that buy and sell stocks on the same day.

Motley Fool Customer Reviews

There are so many Motley Fool customer reviews about the Fool’s online and it has received so much positive feedback. The fact that the company has been helping out so many investors especially the new investors, they have received so much love from the public.

It was not always so, but the service it has provided for more than 25 years has kept them at the top. And the improvised methods they used has got them to the place they are now at.

Bottom Line

If you are looking for a Stock advisor, then, Motley Fool is highly recommended. Here, you don’t have to take any risk and you can get a full refund if you think it is not working for you. In addition, you get to access all the records and research the company has ever made all these years. The company has offered its service at a reasonable price so that anyone who is interested in investment can make good use of it. At the same time, their services are so easy to use that you do not have to go through complicated and thorough research because they have done it all for you. There is definitely nothing to lose, Subscribe today and enjoy the benefits.