Kabbage Small Business Loans Reviews: How does it work? Features and benefits, Complaints, #Kabbage Comparison with other lenders, Pros and Cons, and FAQs.

About Kabbage Small Business Loans

Established in 2009, Kabbage small business loans is an online lender that offers lines of credit to qualified businesses. Finding a moneylender more advantageous than Kabbage would be troublesome. As a rule, business proprietors can apply, get a choice on their rates and fees, and begin drawing funds inside a couple of moments. That is truly quick, in any event, for an industry that is known for coming to snappy lending choices.

The speed includes some significant pitfalls, however. With fees that can reach up to 10% of your obtaining sum every month, this moneylender gives a portion of the more costly loans you’re going to go over. Regardless of the possibly significant expense, there’s a great deal to like about Kabbage. The application is quick and simple, reimbursements are made month to month (instead of every day or week after week), and the revolving line of credit-style loan offers a simple to-get to monetary security net.

Is this the right loan for your business? Read on for the details!

Who Owns Kabbage?

Kabbageis owned by Petralia and Rob Frohwein helped to establish with Marc Gorlin in 2009. It has gone through the most recent three years on the Inc. 500 rundown of America’s quickest developing privately owned businesses.

Truth be told, Kabbage’s line of credit is the most effortless to access available — notwithstanding having the option to demand funds through the desktop or mobile app, Kabbage offers a spending card so you can pay for the specific sum directly from your credit line. #KabbageSmallBusinessLoansReviews

Kabbage Line Of Credit Reviews

Kabbage offers only one item: a small-business line of credit.

A line of credit gives you a credit limit and permits you to draw against that breaking point. On the off chance that you have a $50,000 limit, for instance, you can draw $1,000 and afterward $5,000, etc until you’ve withdrawn up to your furthest reaches of $50,000.

As you reimburse what you’ve acquired, those funds become accessible once more. Payback $5,000, and you’ll have another $5,000 you can obtain. That is the reason Kabbage business lines of credit are classified as “revolving” credit, and it implies you’ll have working capital close by when you need it. #KabbageLineofCredit

Kabbage Company Features

Different highlights likewise make Kabbage small business loan provider a decent choice for small businesses. Its online lending stage implies you can get to funds any place you have a web association. It additionally makes it simple to deal with your line of credit and comprehend your money related circumstance. Kabbage may likewise furnish you with a Kabbage card, which works as a physical card for withdrawing funds.

Services Offered & Types of Funding

Kabbage loans reviews just offer one sort of financing for small business proprietors reviews and that is a line of credit that accompanies an ensured half-year reimbursement alternative, with the capability of additionally getting a year and 18-month reimbursement choice if the borrower meets the qualification necessities.

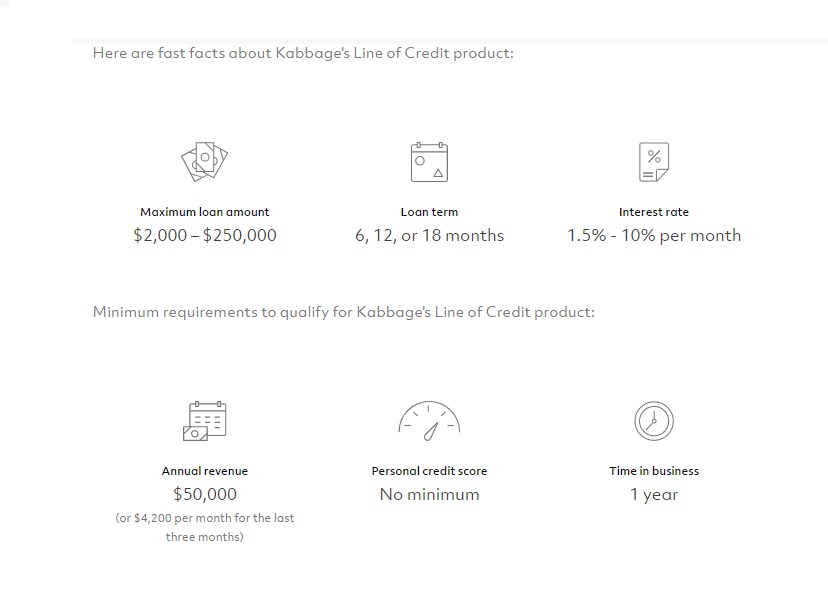

Eligibility Criteria

Kabbage’s base necessities for its borrowers qualifications are moderately clear. For a loan that is under $200,000, the customer ought to have yearly incomes of in any event $50,000. The business ought to likewise have been in activity for in any event one year.

To be qualified to apply for a small business line of credit from Kabbage, you should meet the accompanying criteria:

- Minimum yearly income: $50,000

- Minimum time in business: 1 year (3 years for lines up to $150,000)

Kabbage loan reviews doesn’t have a base FICO score required, be that as it may, you will agree to a credit check during the application procedure. This is a one-time hard request, and it permits Kabbage Small Business Loans to reviews the data inside your report while thinking about approval. Borrowers qualifications in reasonable for fantastic classes are bound to qualify. #

Rates and Fees

Allows first to investigate what is “straightforward” about fees and rates on a loan from Kabbage. There are no additional fees; there is no origination fee, draw fee, record fee, membership or activation fee, or even a prepayment punishment on the 6 and year loan terms. Where there “might” be an extra fee, as indicated by the Kabbage website, it is in the event that one of its outsider referral accomplices charges a fee (which can be up to 1.5% every month).

Terms and fee structure on Kabbage’s website:

- Borrowing Amount: Up to $250,000

- Draw Term Length: 6, 12, or 18 months

- Borrowing Fee: 1.5% – 10% of the borrowing amount per month

- Draw Fee: None

- Effective APR: 24% – 99%

Kabbage loans have a term length of either six, 12, or year and a half.

For the initial two months of a six-month loan, and the initial a half year of a year loan, your fee will be somewhere close to 1.5% and 10% of the first principal every month. For the rest of the months, your fee will be 1% of the principal. Befuddled? Kabbage business loan rates have a pleasant loan calculator on its website, which might be useful for seeing how the fees work.

Points to be noted:

- Because of the manner in which the fees are given, kabbages loans don’t actually convey an APR. In any case, the assessed APRs go from about 24% to 99%.

- Other than the month to month getting fee, Kabbage Online Loan Reviews doesn’t charge extra fees. For instance, you won’t be charged draw fees, support or adjusting fees, unused line fees, or a prepayment punishment.

- Before you get your loan, kabbage business loans review will send you a SMART Box that will unveil all that you have to know to settle on an educated obtaining choice, including the total loan fee and the viable APR.

Application Process

It just takes a couple of moments to apply for a loan with Kabbage short term. The initial step is rounding out an application online business finance or via telephone. Set up essential personal and business data, including your email address, business name, and address, telephone number, the industry your business is in yearly income, the date your business was built up and banking foundation. In addition, you should give your online banking data, as Kabbage small business loans reviews will deduct funds automatically from your business accounts every month until the loan is paid off. You may also need to give extra-budgetary data to check your month to month/yearly income and affirm your ownership job inside the business.

When you’ve applied, you ought to include an answer inside 10 minutes of presenting your application, as indicated by Kabbage’s website. On the off chance that you apply and don’t like the terms and rates you meet all requirements for, there’s no commitment to work with Kabbage business loan reddit.

Help & Support

Kabbage customer support is accessible by means of the telephone during customary business hours, just as through email and all standard online business life stations – Facebook, Instagram, Twitter, and LinkedIn. The organization bends over backward to react to all requests inside 24 hours access to funding. The kabbage business loans reviews website additionally has an FAQ page that clarifies how the organization was established just as its strategies and will give borrowers a superior comprehension of who they are working with. The website likewise gives access to its Privacy Policy and Celtic Bank’s Privacy Policy.

Collateral

Loans with Kabbage are unbound, which implies you won’t need to set up resources as a guarantee. Kabbage business loan Reddit, in any case, requires a personal assurance.

Time Until Deposit

When you’ve been approved by Kabbage, funds can be saved into your account that equivalent day. The official store will likely happen one to three days after the loan understanding is settled. There were just a couple of organizations we reviewed that offered same-day utilization of funds. This is a major differentiator for Kabbage – in light of the fact that it’s a line of credit loan, money market; Kabbage’s online stage permits you to start drawing on it that day you’re approved.

Online Platform

Kabbage’s foundation and app work nearly like an online banking program. You can without much of a stretch withdraw funds, see the installment plan, the “fee” (or financing cost) related to the exchange and view your general loan history. The user also can withdraw funds as often as at regular intervals.

Special Documentation

On the off chance that you band together with Kabbage, you won’t need to give a great deal of money related documentation, as indicated by Kabbage delegates. Kabbage small business loans reviews just require bank account articulations to check the money related strength of your business finance. It’s in every case great to have other data primed and ready, like assessment forms or other budgetary documentation, savings accounts however the idea of Kabbage’s loans implies that you aren’t required to give broad documentation.

Pros & Cons

Kabbage Small Business Loans PROS Reviews:

- Kabbage reviews take a gander at the complete financial picture to measure credit card value

- Eligibility not restricted to high credit score

- Small and more current businesses qualified

- Fast application and time to subsidizing

- Ideal for borrowers looking for short-term funding

- No yearly or month to month support fees

- No prepayment punishments on the first half-year and year loan term

Kabbage Small Business Loans CONS Reviews:

- Kabbage small business loan review doesn’t work with new companies

- Higher financing costs for borrowers with poor personal credit card

- Businesses must utilize services of online banking

- No long-term loans

- Fees are front-stacked on the 18-month loan term and higher fees toward the start of the 6 and yearly loan terms

Kabbage Small Business Loans Complaints Reviews

The most common Kabbage complaints are given below:

Rejections:

Unfortunately, Kabbage smallbusiness loans can’t stretch out credit lines to all applicants. Regardless of whether you meet the organization’s base needs expressed prerequisites, you probably won’t be qualified dependent on other data they find during the application procedure.

Expensive Fees:

With fees that have an equal APR somewhere in the range of 24% and 99%, Kabbage loans can be costly. On the off chance that you are stressed over cost, I’d suggest looking a piece before choosing a line of credit. Look at our rundown of the best business lines of credit for 2019 to see some different choices you may be qualified for.

Front-loaded Fees:

Kabbage complaints have gotten analysis in light of the fact that the heft of their fees must be paid in the early piece of the reimbursement term. In spite of the fact that they, in fact, don’t have a late payment punishment, the front-stacked fees can make it hard to spare a lot of cash by reimbursing early.

Sudden Loan Limit Cut: Kabbage loans review watches out for your income, so if business finance is beginning to turn sour, they may decrease your obtaining point of confinement or remove your business credit line. In the event that this happens, you’ll despite everything need to reimburse any remarkable obligation you have.

Compare Reviews Of Small Business Loans Like Kabbage

Kabbage vs. OnDeck

OnDeck is a superior choice than the Kabbage credit limit on the off chance that you want to meet all requirements for an APR under 20%. An OnDeck business loan similar to cabbage offers lines of credit and small business term loans up to $100,000 and $500,000, individually. To be qualified, you should also be in business for one year with $100,000 in yearly income. You’ll additionally require a personal credit score in any event 500.

OnDeck requires day by day or week by week reimbursement, which – relying upon your business – could be a positive or negative thing. If you should have a month to month reimbursement plan, Kabbage is the better decision. One thing we do like about OnDeck is that the bank also decreases fees on each consequent loan you take out, and you might be even ready to fit the bill for a lower financing cost too.

Highlights (loan)

- APR: 9.30% – 99.70%

- Amount: $5,000 – $500,000

- Terms: 3 – 36 months

- Repayment: Daily or weekly

Also, read about Stock Investment Advisor here!

Kabbage vs. Fundbox

In the event that you can’t meet the qualification criteria at Kabbage, Fundbox is another acceptable decision for working capital financing. Qualifying at Fundbox depends on your time in business (2 or 3 months, contingent upon the item you pick), some income ($25,000 for a line of credit). Also, no bankruptcies in the previous two years and your utilization of accounting software and your business bank account.

There are no base business credit score necessities to fit the bill for receipt financing or a line of credit, and in spite of the less severe qualification criteria, Fundbox offers APRs at 13% to 60%. Accounting software administrations that Fundbox works with include QuickBooks, FreshBooks, Xero, Harvest, Clio, and Zoho. Fundbox offers both a receipt financing and line of credit item, and it is possible that one can assist you with income holes or working capital needs. Like Kabbage, Fundbox additionally offers snappy financing – in as quick as one business day, now and again.

Highlights (invoice financing)

- APR: 13.00% – 60.00%

- Amount: $100 – $100,000

- Terms: 12 or 24 weeks

- Repayment: Weekly

Kabbage vs. Funding Circle

Funding Circle offers lower mortgage rates and bigger loan sums than Kabbage business loan rates. In any case, it just offers term loans, so in case you’re searching for a line of credit, you’re in an ideal situation taking a gander at Kabbage shortterm loan. You can acquire up to $500,000 through Funding Circle with rates somewhere in the range of 8% and 33% and developments of one to five years.

Meeting all requirements for a Funding Circle business loan provider is also somewhat more troublesome: you’ll be in two years types of business with $150,000 in yearly income. Your business must be incorporated or an LLC, and show profitability for as far back as two years. You’ll also need to have a personal credit score of 620 and have the option to personally ensure the shortterm loan. Since Funding Circle is a commercial center moneylender, it can take as long as 10 days to support your loan offer.

Highlights

- APR: 4.99%-22.99%

- Amount: $25,000 – $500,000

- Terms: 6 – 60 months

- Repayment: Monthly

Kabbage vs. PayPal Working Capital

PayPal Working Capital is appropriate for businesses that make a larger part of their deals through a business PayPal account, so on the off chance that you don’t utilize PayPal, Kabbage is the victor here. While Kabbage offers a few focal points for PayPal clients, you’ll likely get a lower rate by getting a short term loan from PayPal legitimately.

You can get up to 18% of your previous year PayPal deals, up to a limit of $97,000. Rates go from 15% to 30% with terms as long as a year and a half. To fit the bill for a PayPal working capital loan, you’ll also need a PayPal business or chief account for as far back as a quarter of a year with $15,000 or $20,000 in net yearly income, individually. PayPal requires everyday reimbursement, however just on the days when you make deals.

Highlights

- APR: 15.00% – 30.00%

- Amount: $1,000 – $200,000

- Terms: Up to 18 months

- Repayment: Daily

Where to Apply for Kabbage Loans?

You can apply for Kabbage Small Business Loans through its official Website. As mentioned above, you will need to follow some procedures to get loans. But you don’t have to worry so much about the procedures because they are pretty much quite easy to follow.

FAQs – Reviews of Kabbage Small Business Loans

What credit score do you need for kabbage?

Minimum qualifications: Kabbage requires a minimum credit score of 560, in any event, one year in business and has a yearly income of at any rate $50,000. You likewise need to have a business checking account or online installment stage, for example, PayPal or QuickBooks.

How long does kabbage take to fund?

Kabbage team can support loans as fast as that day you apply, however, it can take up to three business days, contingent upon where you get to the funds (e.g., checking account or PayPal account).

What is the monthly fee for a kabbage loan?

Be that as it may, a 6-month term requires a $2,000 least loan. Fee rates extend from 1.5% to 10% dependent on a few business execution factors. Look at their example fee calculator to discover what your fee rate could also be. 1.5% – 10% of loan sum, contingent upon creditworthiness.

What is the minimum credit score for a small business loan?

As a rule, SBA loan credit score essentials commonly fall something close to 620-640+. So, the credit score required for an SBA loan will rely upon which moneylender you work with and which SBA program you decide to apply for.

Does Kabbage do a hard pull?

Kabbage small business loans will ask Experian to play out a hard credit pull during the last advance of your application, which will influence your credit score somewhat. Contingent upon the documentation you should give, you may get your funds around the same time or up to 7 business days.

Does Kabbage do a hard credit check?

During the third period of the application procedure, you are approached consent for Kabbage team to pull a credit check. This is a hard keep an eye on your credit and can have a five-point or so descending plunge for around a half year or thereabouts. Future moneylenders will have the option to see the hard check when thinking about subsidizing future loans.

Are Kabbage loans good?

While Kabbage loans are costly, they can be a sensible choice for borrowers with poor to reasonable credit. What’s more, in light of the fact that Kabbage Small Business Loans Reviews can rapidly store funds to a PayPal account, it very well may be a decent item for businesses that need a monetary security net to cover crisis costs.

Are Kabbage loans personally guaranteed?

Kabbage does require that you sign a personal guarantee because their loans are unsecured which allows startups and growing small businesses to qualify for it.

Conclusion

Numerous businesses will be qualified for their administration, the application procedure is quick and easy, the capital is consistently there when you need it, and they don’t charge additional fees. When all is said in done, Kabbage small business loans is extremely straightforward — you’ll know it all you need before obtaining cash, and you wouldn’t get any surprise on the way.