E-File Reviews: What is E-file? Easy Tax Returns In 7 Minutes. What are its features? Comparison with other services, Pros, and Cons. How to access e-file.com? FAQs. Customer Reviews.

Introduction: E-File Reviews

In case you’re a veteran tax-filer who realizes how to navigate the various tax structures, tax deductions, and credits, this is the program for you. The e-file program doesn’t offer a question-and-answer format for inputting your information and offers minimal guidance or backing. Basically, e-File is a tax software best geared toward extremely simple returns or those who are experienced with filing their taxes filed and needn’t bother with assistance preparing their returns. Keep reading this e-File reviews to see if this is the best tax software for you.

Filing your IRS (Internal Revenue Service) and state taxes can be an exhaustive process. The time is also consuming and it tends to be very stressful to get your income tax returns filed on time. E-file makes this process easier because it offers tax-preparation software. This also ought to allow you to file your tax returns faster, safer and more accurately. Be that as it may, does it deliver on these promises? You would prefer not to take gambles when it comes to your tax returns, so you need some assurance preparation and efile that the service is reliable before you confide in it to handle your tax returns.

What is E-file?

E-File is the newest tax preparation space software. The cost is half the price of many comparable programs, yet it has limited explanations and helps in the event that you have questions.

E-file is an electronic filing system that allows individuals and businesses to file their income tax returns over the internet. There is, for example, one section for income, one section for expenses, and so forward. Each section has its own subsections. After answering some questions, the balance transfer software will also guide you toward completing the relevant structures and schedules for your unique situation.

On the off chance that deluxe edition you already realize which structures apply to you, feel free to skirt the interview at the beginning of each section.

WHAT YOU NEED TO E-FILE:

- a valid email address (The District will keep your email address confidential.)

- Owner ID

- PIN number

E-file Features Reviews

All of the e-file software reviews tax return plans come with the following features:

Earlier Year Return Importing from E-file.com

On the off chance that you filed your return with E-file.com last year, you can import its information directly into your current-year return. However, you can’t import from other online tax prep services.

Filing Prior-Year Returns

In the event that you failed to file a return for an earlier tax year, you can use one of E-file.com’s three plans to do as such. Note that you can just claim tax refunds going back three tax years. In case you’re filing for an earlier year, you’ll forfeit any refund to which you may have been entitled. #efile #e_file_reviews #e_file.com_reviews

Backing Ticketing

E-file.com’s primary mode of customer support is an email-based ticketing system. To use it, firstly, you round out a simple structure on the website, provide written detail about your problem, and send it off to E-file.com’s staff. The system typically produces an email response within one business day.

Audit Assistance

E-file.com offers an optional audit assistance add-on at no additional charge. On the off chance that you select into audit assistance and the IRS subsequently audits your return, E-file.com handles all communication with the IRS on your behalf and provides regular status updates. #efilereview

Help Sidebar

As you move through each IRS (Internal Revenue Service) e-file reviews return interface structure, the sidebar also automatically updates to reflect your position filing for selfemployed. However, the advice is generally quite basic, and often not that helpful – for instance, when you mouse over an address field, the sidebar says something like, “Enter your home address,” or “Enter your business address.”

Pay With Your Refund

E-file.com lets you pay for filing your tax preparation fees with your tax refunds, and also eliminates the need to provide your credit card information for a forthright payment. This service is provided through EPS Financial, a partner company. There is a $19 fee for choosing valentino e file reviews this payment method.

Free filing your tax in the event that you meet certain criteria.

Pros

Our e-File reviews will turn out some of the top professionals in choosing this software:

Deduction comparison

The software shows e file taxes review deductions on the federal return and also shows how you compare to the national averages on popular online tax deductions. This Kuku e file review information can be useful for determining on the off chance that you fall too far from the averages. In case you’re too far from the averages, you know to search for possible identity theft and errors.

E-File Free filing Reviews available

The software Kupa e file reviews offer a free federal return item for some people. To qualify, you should earn under $100,000, be younger than 65, and be single or married, filing jointly without any dependents.

Great budget alternative

This program’s ugly duckling e file review is particularly cost-effective on the off chance that you meet the restrictive criteria for its free item. However, the premium item just costs $45.99, less than half the costliest TurboTax item.

E-File Affordability Reviews

The costs of E-file’s services are also known to decrease over time and are more affordable than its competitors. In the event that you are eligible for 1040EZ filing, you can file your taxes without paying a cent, and on the off chance that you have to present multiple state returns, this software may also be the most affordable arrangement available to you.

Straightforward Interface

The young nails e file review interface has a simple appearance, and cd rates you won’t have to navigate a lot of screens to prepare your tax refunds. After completing a section, user interface with inexperienced tax preparer filers will also have no trouble knowing where to snap to move forward with the process.

E-File Excellent Security Reviews

The review of e-file has some pretty severe money market accounts and password requirements, and e-file software reviews times out after ten minutes, so you can rest assured that your information and privacy are protected.

Cons E-File Reviews

There are also some cons you ought to be aware of as you read our e-File reviews:

No phone support

Currently, the e file nails review tax software offers no phone backing to give you help on the off chance that you have any questions. You can attempt to contact the company through e-mail with your questions. However, this isn’t the same as talking directly to a human with an immediate response.

Not suited for complicated returns

Those with limited simple returns experience and complicated returns should probably look for other ways. Because of the e-file reviews effortlessness and low-level help, you won’t have much help on the off chance that you need it.

Simple design and functionality

The software design is also similar to TaxSlayer’s interface except it offers no video support or intensive explanations. The limited life insurance guidance and explanations provided aren’t intuitive, another reason that this software is not the best for people who aren’t experienced filing taxes.

No Free State Returns

E-file doesn’t offer Free State filing like some of its competitors, which may lead some tax liability filers to look elsewhere. Even if your tax preparer situation is relatively simple, you should pay IRS e file review on the off chance that you live in a state with earned income taxes.

How to ACCESS E-FILE?

To access the E-file system, visit our efile login website at E-file.com and enter your login information. Your PIN is case sensitive. Please enter your PIN exactly as it appears. Try not to share your PIN; it is considered your signature. In the event that you lose your PIN, contact the District to receive another via USPS mail. Your deadline won’t be extended while awaiting your PIN.

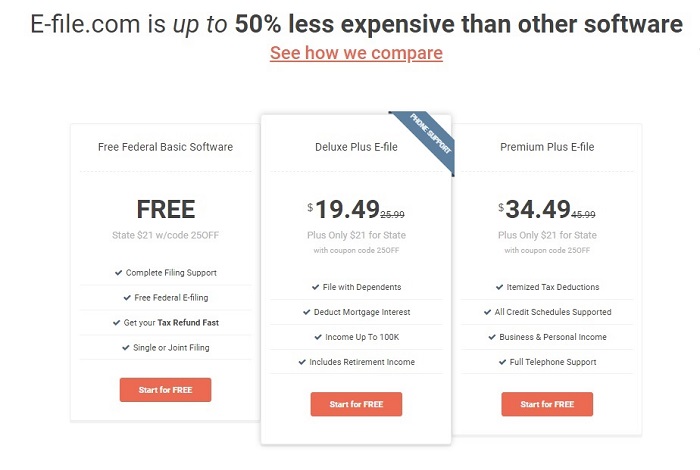

How much does eFile cost?

E-file.com pricing and premium plan Options:

E-file.com reviews offer three plans. Of note: each plan’s state return efilecom pricing is useful for multiple state returns, hr block regardless of how many taxes filed you need to file.

The costs of state tax return filing are the same for all three plans.

1. Free Federal Edition

- Federal Return: Free

- State Return: $17.50

The Free Federal Edition is appropriate for single and joint filers without dependents or the need to file additional schedules – basically, anyone who can complete their taxes using Form 1040EZ as it filed an extension.

2. Deluxe Plus Edition

- Federal Return: $17.49 (normally $24.99)

- State: $17.50

Deluxe plans are appropriate for single and joint filers with dependents, as well as anyone else who can complete their taxes using Form 1040A.

The deluxe edition is appropriate for filers who can complete their returns using Form 1040A as it were. Specifically, filers must meet these criteria:

- Income: Your taxable income can’t exceed $100,000.

- Itemized Deductions. You need to upgrade to Deluxe to itemize your deductions while e-file.com’s software provides automatically itemize or claims the standard deduction.

- Additional Credits and Deductions: All other common credits and deductions for individual filers – not including deductions associated with the business or rental income – are also available with the Deluxe plan.

3. Premium plan Edition

- Federal Return: $31.49 (normally $45.99)

- State: $17.50

The premium plan is appropriate for people with moderate to very complex tax liability situations, for instance, those with investment income, retirement income, small business loans and income, student loans, earned income, and rental property income.

E-File Accuracy Guarantee Reviews

E-file.com reviews have a guarantee policy that protects users against calculation errors caused by software glitches.

In earlier tax years, the balance transfer guarantee wasn’t very well advertised – in 2016, I thought that it was buried in a dense article about how E-file.com functions subject to change. Fortunately, E-File.com updated its website for 2017 and 2018. The platform presently clearly advertises the accuracy guarantee, along with the kind of maximum refund guarantee that’s common among online tax forms prep providers.

E-file Comparison Reviews

E-file.com versus competitors

- TurboTax – You aren’t talking about tax software without TurboTax being mentioned. TurboTax is also one of the most recognized name in online tax filing.

- FreeTaxUSA – A completely free choice for all federal returns. FreeTaxUSA has a nice niche, but is lacking a little in the bells and whistles.

- TaxSlayer – With a long history and highly competent team, TaxSlayer has also emerged as a top tax filing choice.

- E-file.com is affordable, the user interface also makes the filing process relatively easy, and it has a customer bolster staff.

Maybe usability and convenience are important to you. E-file.com’s user interface is pretty straightforward, however, it’s lacking some features that competing companies offer.

For example, TaxAct and TurboTax let you select all the life situations and gives you an answer. This way, you realize which plan to use and what you’ll pay before you even get started. The complex return ability of e-file to skip around the website, rather than take care of out everything in order, makes filing more convenient.

FAQs

Can E-File.com Help Me With Crypto Investments?

E-File.com didn’t specifically ask about virtual currency investments at the start of the filing process but, explains how to get gains and trades in the appropriate schedules.

Who Should Use E-File 2019-2020?

In 2020, E-File.com offers middle of the road pricing for most customers, yet the software doesn’t legitimize the price. In the event that you want the best value for mid-tier pricing, I unequivocally recommend TaxSlayer Premium. Or then again, on the off chance that you qualify, check out H&R Block’s Free Edition (free for HSA, dependents and student loan interest).

Which online tax service is best?

There are so many tax services out there. But not all of them provide the same features available in e-file.com. E-file is also considered one of the best and has gained its reputation as one of the most reliable tax software services. But you can always check out reviews on which is best suited for you.

Is eFile com safe?

The website has been updated and has an accuracy guaranteed for its users. Therefore, e-file reviews safe for its users. This is because of the excellent and robust features of the software.

Is eFile a legitimate website?

Yes, the website is legitimate and approved.

Conclusion

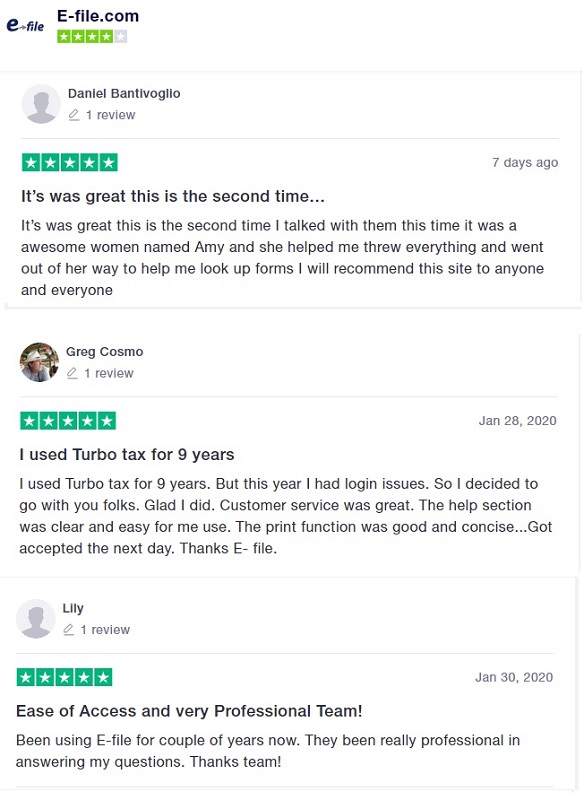

E-file is an affordable, straightforward, and secure alternative for filers with both simple and complex tax issues. As you work with E-file, the software becomes even more beneficial. Because it allows you to easily import previous year’s tax returns.

The e-file customer reviews support is also top of the line, ensuring you get the assistance you need when you’re facing an IRS audit. Whatever your tax filing situation, E-file can help you to file without a headache and perplexity this year. You can also take a glance at federal income tax guide to help you along the way. Visit below to get started today!