Read this article to learn about the 9 ways to get a loan for a small business. You also learn about the types of loans that are available for small businesses and their advantages and disadvantages.

Introduction

Loan is the act of lending money by one or more persons, organisations, or other entities to other individuals, organisations, business, or entities. The borrower, also known as the recipient, incurs a debt. It is normally responsible for paying both interest and the principal amount borrowed until the obligation is repaid.

The principal amount of money borrowed, the interest rate charged by the lender, and the due date are usually specified in the paperwork confirming the obligation.A loan entails the reallocation of the subject between the lender and the borrower for a set period of time.

The lender entices to participate in the loan because of the interest. Each of these obligations and limits is enforce by contract in a legal loan, which can also impose further restrictions on the borrower.

The provision of loans is one of the primary functions of financial entities such as banks and credit card firms. For other organisations, issuing debt contracts such as bonds is a common source of finance.

Advantages And Disadvantages Of Bank Loan

In brief, we shall discuss the advantages and disadvantages of bank loan in the following lines:

- Flexibility: As long as the payments are on a regular and timely basis, a bank loan permits you to repay it whenever you want. Unlike an overdraft, where the entire credit limit is deducted all at once. Alternatively, a consumer credit card with a maximum limit that cannot be use all at once.

- Cost Effectiveness: When it comes to interest rates, bank loans are usually the most cost-effective alternative when compared to overdrafts and credit cards.

- Profit Retention: If you raise money through stock, you must split earnings with your investors. However, with a bank loan, you do not require to split earnings with the bank.

Types of loan for small business

Secured Loan

A secured loan is a sort of debt where the borrower assumes certain assets as security such as a car, a house. A mortgage loan is an extremely prevalent loan type to buy property. Until complete payment of the mortgage is made to the lender that is usually a financial institution, the security – a title bond – is granted.

If the borrower defaults on the credit for home loans, the bank would have the legal authority to take the house away and then sell the house to collect amounts due to it.

In some ways, the car can secure a loan to purchase a car. The length of the loan is somewhat shorter, which is generally the lifetime of the car.

Lower Your Monthly Mortgage Payment Here!

Auto Loans

Two sorts of auto loans are available, one being direct and the other indirect.

In a direct car loan, the bank directly loans money to a consumer while, as the intermediary between the bank, the financial institution and the consumer. The vehicle dealer or a connected firm functions in an indirect auto loan. The loans against securities, such as share, mutual funds, bonds, etc., represent other ways of secured lending.

This instrument provides consumers with a credit line based on the quality of the guaranteed securities. After an assessment of the quantity and quality of gold in the pledges, gold loans are offer to consumers. Corporations can also pledge the assets of the company, even the firm itself, to secure funding.

The interest rate for loans secured is generally lower than the interest rate for loans not guaranteed. The lending institution usually employs individuals on a roll or on a contract basis. It is to analyse the quality of the collateral committed before the loan is sanction.

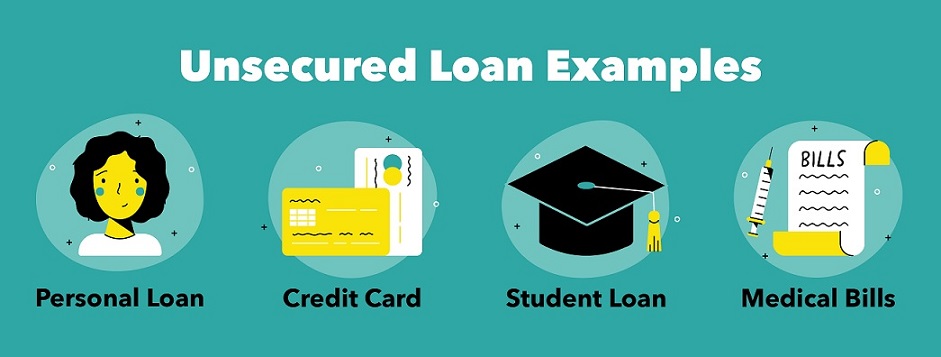

Unsecured loans

Unsecured loans are ones that aren’t back by the borrower’s assets in any way. Personal loans, credit cards, bank overdrafts, peer-to-peer lending, corporate bonds, and credit facilities or lines of credit are only some of the options available from financial institutions under various names or marketing packages.

Interest rates on these various kinds may change depending on the lender and the borrower. These could be governed by legislation or not. Because an unsecured lender’s rights for recourse against the borrower in the event of failure are limit severely, interest rates on unsecured loans are approximately twice as high as interest rates on secured loans.

A not secured lender must sue the borrower, get a judgement on the money of the contract violation and then take the decision against the unencumbered assets of the borrower into account. When the court divides the debtor’s assets, secured lenders have traditionally preference over unsecured lenders in insolvency proceedings.

Demand Loan

Demand loans are short-term types of loans that usually have no defined time for the reimbursement of the amount. They are subject to a floating interest rate that depends on the prime loans rate or other established contractual criteria.

The credit institution might be requested at any time to reimburse demand loans. Either unsecured or secured, demand lending may be.

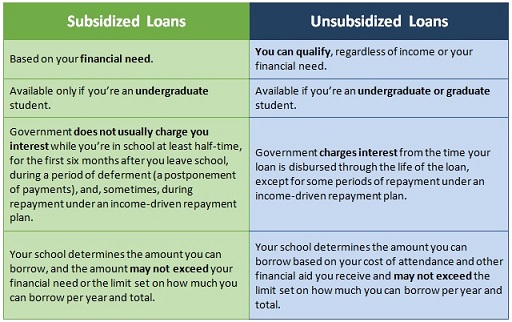

Subsidized Loan

A loan subsidized is a kind of loan in which an explicit or secret subsidy reduces the interest. This refers to a loan in which there is no interest while a student continues enrolled in education in the United States.

Concessional loan

A concessional loan, is sometimes known as a soft loan. It lends on terms that are significantly more favourable than market loans, such as lower interest rates, longer grace periods, or a combination of the two.

Such loans are mostly for developing countries by foreign governments. Or they offer to the staff of lending institutions as an employee benefit known as a perk.

Get Small Business Loans Here!

9 Ways To Get Loan For Small Business

There are many types of small business loans available. Following are some ways on how you can get a loan for small business:

PPP Loans

Pay Check Protection Program allows for loans to qualified small enterprises. And the debts shall be forgiven if the loan goes as intended. Payroll costs, rent, service payments, operating expenditures, non-insured property losses, protective equipment costs, etc. are certain types of expenses that are available for the use of PPP loans.

SBA Disaster Loans

Small Business Administration (SBA) has a catastrophe loan programme for firms that faces a disaster, such as the recent Covid-19 outbreak.

The COVID-19 Economic Injury Disaster Loan is to assist firms that suffer economic damage. Small enterprises who have incurred significant economic damage as a result of the Covid-19 epidemic are eligible borrowers. [s]

Working capital and typical operational expenditures are also possible uses for loans. Loans normally have a 3.75 percent interest rate and are repayable over 30 years.

Unlike PPP loans, EIDL loans are not forgiven. There are no penalties or fees for paying in advance. Although interest accrues during the first year of the loan, payments are postponed.

SBA Small Business Loans

Some banks give small firms that are getting support. They are guaranteed SBA attractive low interest rate loans. The rate and reimbursement parameters for SBA guarantees are more favourable than most loans.

The financing process, however, can take time to meet stringent conditions for qualified small companies.

Get Small Business Loans Here!

Equipment loans

Through the available equipment loan, small companies can buy equipment, vehicles, and software.

In general, 20% of the purchase price of the equipment needs to be paid down and the loan guaranteed by the equipment.

Interest on the credit is paid each month, usually over two to four years. The principal is amortised. Sometimes equipment lending may also be organized as equipment rental.

Small business credit cards

Though some business owners might be a bit sceptical about the use of small business credit cards can also function as short-term finance for small companies. The interest rate varies according to the issuer of the card, the available amount on the card, and the card holder’s creditworthiness.

The main owner must be co-favourable with the company by several small business credit card lenders. For a brief while, several credit cards offer 0 percent promotional rates.

Cashback and bonus schemes can allow you to receive credit card benefits from your purchases and rewards programs allow you to earn rewards from purchases on the credit card.

Small business term loans

Typically, a fixed sum is a term loan. They are for the sake of business, equity or expansion. Interest payments are on a monthly basis and the principle shall be refundable within six months to three years.

Term loans can be guaranteed and unsecured, and interest rates can vary or be fixed. It is suitable for small companies which require funds to grow or to spend heavily.

Read about 7 Best Investment To Make In The Stock Market For Long Term!

Direct online lenders

Some internet lenders give small company lending via an online method. Reputable organisations like PayPal can provide cash progress, working capital loans and short-term loans to very rapidly small businesses in sums.

Connect With Online Lenders Here!

Large commercial banks

Banks are the typical lenders to the small business industry. There are a variety of large commercial banks that can provide you with a loan these days. Due to more stringent loan underwriting requirements, the loan approval process takes a little longer.

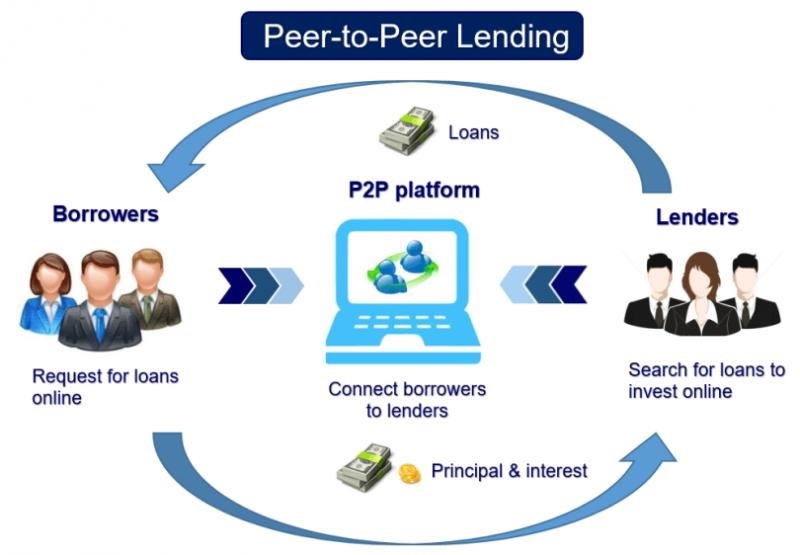

Peer-to-peer lending sites

There are a variety of websites that function as intermediaries between small borrowers and individual and institutional lenders. These lenders are able to make choices rapidly.

Apply For Small Business Loans Here!

Conclusion

Before jumping to the conclusion of taking a loan for your small business, you should consider some points first. Small business loans are available both from a large number of traditional and alternative lenders. It may also differ depending on the country or region that you live in.

Small business loans can help your business grow, fund new research and development, it will help you expand into new territories, enhance sales and marketing efforts, also allow you to hire new people, and so on. Choose the right loan for yourself and your business according to your needs.