About Forex Trading

Forex trading work as the largest market in the world. And when we talk about largest, the particular question may come to your mind as to how big it have to be, to be considered as the largest market in the world, right?

So, to answer this, it is believed that, on an average trading day, the forex market trades about five trillion dollars. This is a humongous amount of movement for one trading day, making it the largest market in the world.

The forex market has been in practice since centuries ago. Although it may not have been done digitally like today, people have followed barter system or the means of exchanging goods and services for so long now.

However, with the advancement of technology, we can’t ignore the fact that the forex market today is one of the many products of modern invention. It has become far more advanced, accessible, and sophisticated.

What is Forex trading?

In the forex market, what you are trading is called a currency pair, which is the exchange rate between two currencies. In simpler terms, forex trading or foreign exchange trading is a market where currencies are traded.

As currencies are important for the purchase of goods and services, International currencies needs to be exchanged if they want to conduct foreign trade or business.

There is so much of trade going on all over the world. The number of financial exchanges is always increasing and we believe it will keep increasing.

#ForexTrading

Forex trading also tends or work to be the most liquid asset market in this commercial world.

For example, if a person living in the US wants to order a cosmetic product from Korea, either the importer or the cosmetic product company has to exchange the equivalent value of USD into KRW before the product is being dispatched or shipped to another country. Likewise, the same goes for traveling in a foreign country as well. If you are an American, you can’t expect to buy products or visit tourist places with your US dollars in Japan. The traveller has to first exchange the dollars for the Japanese yen to enjoy the benefits of the locality.

How does Forex trading work?

Forex trading is an international market where currency trading is conducted electronically and all transactions work or happens over via computer networks. This process is also called over-the-counter or OTC, among traders around the world. [s]The market is open 24 hours a day and 5 and half days a week.

The major financial centres are Frankfurt, Hong Kong, London, New York, Sydney, Tokyo, Paris, Singapore and Zurich, where all the currencies are traded across almost every time zones. For instance, when the U.S trading day ends, it is a new forex trading day in Japan and Hong Kong. This is why it is excessively active any time of day from any time zone. #HowDoesForexTradingWork

Most of the trading that takes place in the forex market is done by commercial and investment banks on behalf of their clients. However, professional and individual investors can also participate in the market for their own financial gain and benefits.

The Carry Trade

If you are an Investor, you can make a profit from the difference between the interest rates of the two economies. You can short the currency with a lower interest rate and buying the currency with a higher interest rate.

Prior to the 2008 financial crisis, as Japan went through one of its sharpest recession in the economy, it was very common among the traders to short the Japanese yen (JPY) and invest in British pounds (GBP) as the gap between the interest rates of the two currencies were very large. [s1][s2]

This strategy is also referred to as a carry trade. This means buying a high interest currency against a low-interest currency. Initially and even today, most of the highest currency traders belong to large multinational corporations, hedge funds, or individual investors with high net worth. This is because to get into this market, you require a lot of capital to back you up.

3 Major Types Of Forex Market

There are three major different types of forex market:

1. Spot Forex Market

The most common type of forex trading is the Spot Forex Market. Usually when people talk about investing in forex market, they are referring to the spot forex market. The spot market takes place at the exact point or on the spot a trade is settled. Thus it normally takes a short period of time say like, one or two days, to settle the transactions.

In this spot forex market, transaction of currency occurs at faster rate. Moreover, it provides immediate payment to the buyers and the sellers as per the current exchange rate.

In the past, the other two forex markets, i.e. forward forex market and future forex market surpassed the values of spot forex market.

However, today, the spot forex markets have received a major boost with:

- the introduction of electronic trading

- the rapid increase of forex brokers and traders

- volumes of trading take place every day

2. Forward Forex Market

Forward forex market is a private trade contract drawn between two parties which can either be two individuals, companies or government nodal agencies.

Under this, the two parties makes an agreement to trade currencies at the defined price and quantity. This is to be settled on a specific date in the future or within the range of future dates in the OTC markets.

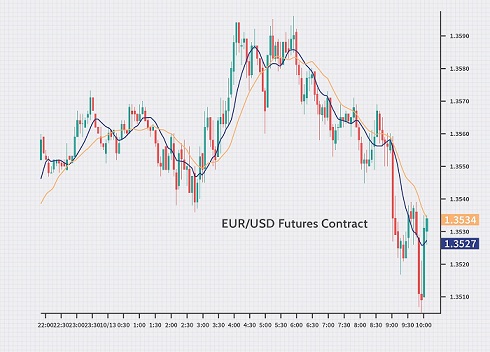

3. Future Forex Market

The functions of forward forex market and the future forex market are more or less very similar. Both the forex markets make an agreement to trade currencies at a specified later date in the future and at predetermined price.

However, what sets them apart from each other is that a futures contract is a standardized legally binding agreement between the two parties.

The future forex markets also come up with solutions to a number of problems that are being faced and encountered in the forward markets. In the U.S, the National Futures Association regulates and monitors the working of the futures market.

It is important to understand that, unlike the spot market, both forward and future forex markets mainly deals in contracts between two parties and not with actual currencies.

Who Are The Participants In Forex Market?

Anyone can participate in forex market provided they have enough capital to support them. In the past and even today, the higher currency traders consist of big multinational corporations, hedge funds, individual investors with high profile net worth, and so on. Following are some of the main participants of the foreign exchange market.

1. Forex Dealers

One of the largest groups of participants in the forex market consists of forex dealers, also known as broker dealers. The majority of the forex dealers in the world are financial institutions. This includes the bank, which is why it is also called an interbank market when the deals are been made.

However, there are notable non-financial institutions as well. It is noted that not every broker participate in all currency pairs available. But rather they specialize in a specific currency pair.

And most of the broker dealers are also known to use their own capital when conducting proprietary trading operations. When we combine both these two operations, the forex dealers mark their significant presence and participation in the forex market.

2. Broker

In general, there is still a lack of brokers in the forex market. However, they exist since brokers are responsible for adding value to their clients by helping them obtain the best quote.

For example, a broker tries to help the client to obtain the lowest buying price or the highest selling price. He does so by making available quotes from several other dealers.

Another major reason for the use of brokers is to conceal their identity while trading. There are many big shot investors and forex dealers who employ the services of brokers to act as henchmen for dealing with big players when trading.

3. Hedgers

Like any other market, forex trading also work to fluctuates in the value of foreign currency. Therefore, there are many investors who ends up creating an asset or liability priced in foreign currency to protect themselves from any losses.

Therefore hedgers take opposite direction in the market when there is an unfavorable movement in their original position. Thus, their profits and losses are legally invalidated and there is stability in their business operations.

4. Speculators

This group of traders has no specific requirements needed for foreign currency. Their only motive is to make profits from buying and selling the currencies.

The number of speculators experiences its peak when the market is booming and every other trader seems to be making money in the forex market. The positions of speculators in the market are temporary as they are only in the business for a short-term profit.

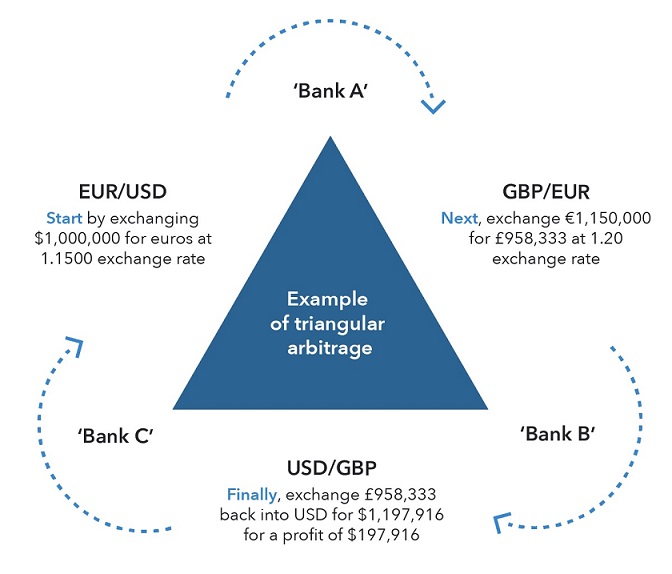

5. Arbitrageurs

Arbitrageurs are those traders that make a profit when there is a lack of agreement or balance in different markets.

They are important in the forex market or trading as they are responsible for proving smooth functioning work and uniform price quotations all over the world. Especially when price discrepancy takes place in the market, until the price balance is restored in the market.

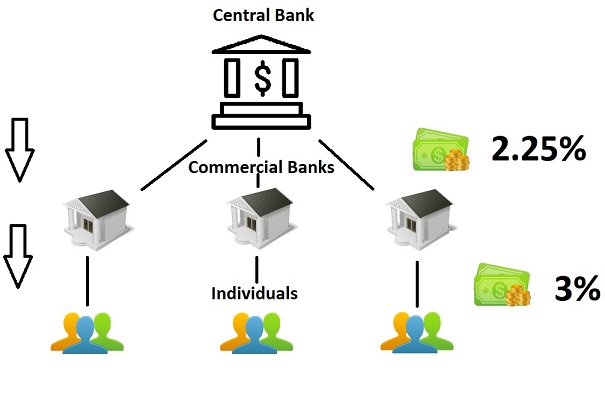

6. Central banks

Studies have shown that Central banks of all countries participate in the forex market up to some certain extent. Trading done by these banks are often for official purposes.

Most of the time these banks participate to meet a certain target range when the currency fluctuates. They also conduct open market operations to back in the range.

Also, whenever the currency of a nation goes under speculative attack. The central banks are responsible to defend their currency in the market.

7. Retail Market Participants

In retail market, participants range includes:

- tourists

- students

- small businesses that indulge in foreign trade

- and even patients travelling abroad for medical treatments as such.

Most of this group of people participates in spot market. However, for people with long-term plans and interests operate in the futures market.

This is because these participants participate in forex market only when they have a personal or professional requirement that needs foreign currencies. Therefore, they don’t engage in this market as part of their regular business.

In short, we can say that dealers are the most active traders with maximum knowledge and information about the market in this platform of forex market. Then it isfollowed by the brokers, other financial institutions and so on.

What Are Some Tips For Beginners Interested In Forex Trading?

To learn any trade not just forex market, one has to always start with the basics first. Here are some tips for beginners who are interested to work or try their hands in forex trading market.

1. Study the markets

There is nothing more stupid than an ignorant investor; hence, it is very important that, you first educate yourself on the forex market before you make your entry.

Learning the basics and the know-hows and whys will prevent you from making minimal mistakes. It will help you save thousands of dollars. Spend some time studying currency pairs and what affects them, before you take any decisions and risking your own capital.

2. Create a trading plan

Create a trading plan with your:

- profit goals

- methodology

- risk tolerance level

- evaluation criteria

- any other points that you might want to add

Creating a plan will help you to have successful trading. It keeps you in check within your plan’s parameters. However, it is also important that you stick to the plan you have made to avoid making any major trade blunders.

3. Know your trading partner

In a large market such as forex market, it is important that you find the right trading partner. This is because pricing, execution and the quality of customer service can all make a huge difference in your experience with trading.

4. Be consistent and patient

Practising consistency is the key to a successful trading. Like any other trading markets, forex market will test your patience when the market keeps fluctuating. This may sometimes impact your trade and incur huge losses.

Try learning to keep your emotions at the door once you enter this field. This is because you may do more damage when you make decisions in haste. This is why creating a plan of your goals is important to deal with situations like this.

No one is ever lucky enough to not experience any losses in this business. Hence, it is wise to stick to your plans when faced with such incidents.

5. Keep your options open but know your limits

Trading cautiously will limit your losses. However, it is also important that you keep your options open. Hence, explore your forex trading plan if things do not work out the way you wanted.

With every wins and losses alike, you will gain much experience and as such, your needs and wants may change. You can always explore your options but with certain limits. Whatever you plan to do, it should always reflect with your financial goals.

6. Keep yourself updated and forecast the weather conditions of the market

Last but not the least; keep yourself updated on any news related to forex market. Some traders like to trade based on news and other financial and political data.

There are also some traders such as technical traders that prefers to trade based on technical analysis tools. For example, Fibonacci retracements and other indicators to forecast market movements.

However, regardless of what tools you choose, it is important that you keep yourself updated on the current trends and find potential opportunities in the market.

How can I start trading in Forex Market?

For a beginner, unless you are 100% sure of your trading skills, it is advisable that you register yourself on a trading account with a forex broker. Then you can use there their client program to start buying and selling currencies.

Go To The Ultimate Best Free Forex Trading Platform

Frequently Asked Questions [FAQS]

What is forex?

Forex or Foreign Exchange is a type of market solely for the purpose of trading international currencies.

What is the difference between forex market and stock market?

The major difference between forex market and a stock market is that, in forex market, whenever a trade is made, both parties are either buying one currency or selling the other because in this market, currencies are always traded in pairs. On the other hand, in a stock market, when you sell a stock you are exchanging it for money.

Who regulates the forex trading?

Forex trading is self regulated and both the parties should cooperatively participate in the market.

What are the working hours and days of forex market?

Forex market operates for 5 and half days a week and is actively open for 24 hours a day since it follows different time zones.

What makes forex market different than the other markets?

The unique feature of forex market is that, unlike other markets, forex trading does not take place on a regulated exchange. It is not controlled by any central governing body. All members trade are based on credit agreements.

What are the types of currencies traded in forex market?

Although some dealers trade exotic currencies, there are seven most liquid currency pairs in the world. They are:

o EUR/USD(Euro/Dollar)

o USD/JPY(Dollar/Japanese Yen)

o GBP/USD(British Pound/Dollar)

o USD/CHF(Dollar/Swiss Franc)

o AUD/USD(Australian Dollar/Dollar)

o USD/CAD(Dollar/Canadian Dollar)

o NZD/USD(New Zealand Dollar/Dollar)